One of the more entertaining advertising campaigns of the past few years is Southwest Airlines’ “Wanna Get Away,” which shows people in situations that become so embarrassing that the best thing they could do was book a flight on Southwest to some exotic place to escape from it all.

One of the more entertaining advertising campaigns of the past few years is Southwest Airlines’ “Wanna Get Away,” which shows people in situations that become so embarrassing that the best thing they could do was book a flight on Southwest to some exotic place to escape from it all.

Millions of business owners have been dreaming of that getaway flight ever since the Great Recession put those plans on hold. The economic meltdown of 2007-2010 caused many businesses to go into survival mode and dried up capital worldwide for acquisitions.

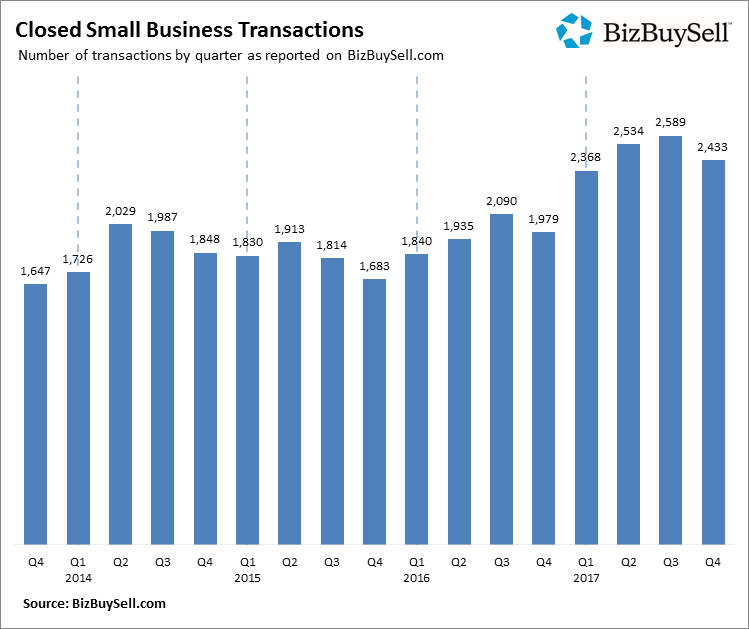

The economy has been making slow-but-steady gains ever since and, according to BizBuySell.com, the Internet’s largest business-for-sale  marketplace, the number of businesses successfully selling in 2017 soared 27 percent over 2016 levels.

marketplace, the number of businesses successfully selling in 2017 soared 27 percent over 2016 levels.

More businesses than ever are changing hands for several reasons, including improved revenues and profits because of the strengthening economy. Perhaps the biggest reason is the influx of companies hitting the market as baby boomers near retirement. According to BizBuySell, 58 percent of the sellers last year were boomers ready to board that getaway flight for good.

Even with a soaring number of deals, the Exit Planning Institute says, only 20 to 30 percent of businesses put up for sale over the next 10 years actually will sell. Few people want to buy a job; they want to buy cash flow and they want to buy a business that can survive without the owner or managing director having to be there every day. In some cases, it takes several years to position a business to sell or transition. You need to determine the value of your company, clean up your financials, adopt an exit strategy, get contracts in order and restructure management, among other things.

This is a critical issue for any area: If a company doesn’t successfully sell, it eventually closes. When that happens, competitors swoop in for the intellectual property and equipment and fill the supplier void. Jobs are lost. Investment goes elsewhere.

Realizing the importance of helping businesses find new owners several banking institutions banded together in 2017 with the Rockford Area Economic Development Council to put on a seminar to help company owners start the arduous exit-planning process. This year, Thinker is getting involved as the presenting sponsor. From 4 to 7 p.m. March 1 at Rockford Country Club, you’ll learn from John Brown, creator of the Business Enterprise Institute Seven Step Exit Planning Process and author of “How To Run Your Business So You Can Leave It In Style,” “Cash Out Move On: Get Top Dollar – And More” and “Exit Panning: The Definitive Guide.”

If you are looking to sell, you’ll come away with:

- Actionable strategies for planning a successful transition.

- Building a strong business to maximize your exit.

- Learn from real-world transition experiences.

If you’re looking to buy, this will be an excellent opportunity to begin the conversations necessary to buying into the right opportunity.

In either case, the Transition & Succession 2018 Seminar will be the perfect time to get started. Click here to reserve your seat today.